UFIT is a global social change movement that helps health clubs build their capacity to welcome people of all abilities into the club. UFIT and the IHRSA Foundation provide training, support, and resources to help clubs change their culture to one of universal accessibility and inclusivity.

One such resource, “Creating an Inclusive Fitness Club and Sector” was released in 2019 by the IHRSA Foundation in collaboration with the Global UFIT Team comprising of the UNESCO Chair in partnership with IHRSA.

Support for UFIT grew in 2019 as eight GymPlus clubs in Ireland joined the UFIT Champion Program, and over 100 clubs became UFIT Supporters and UFIT Recognized clubs.

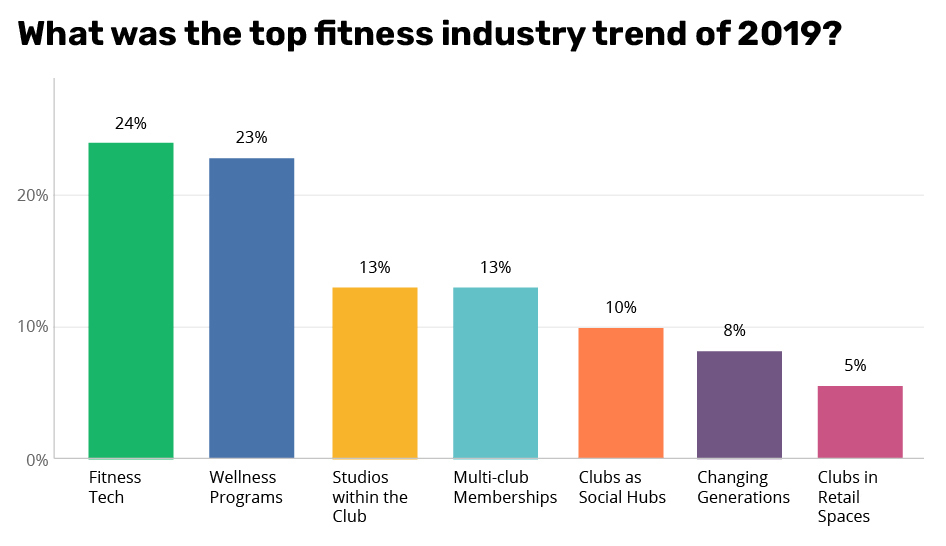

2019 Fitness Industry Trend: Multi-club Memberships

A few years ago, it became clear that members are no longer committed to a single facility but are, instead, leveraging the assets of multiple facilities to pursue their fitness and wellness goals. According to The 2019 IHRSA Health Club Consumer Report, 20% of fitness facility members indicated that they frequent more than one facility. While the industry average was 20%, a member’s likelihood of using more than one facility was highly dependent upon the type of facility they belonged to.

Fitness-only facilities garnered the greatest commitment from their members, with 75% indicating they use only their primary facility, while 15% have a second membership, and 10% have more than two memberships. On the opposite end of the spectrum are boutique fitness studios, where 35% of members report being loyal to one facility, 44% use a second facility, and 22% engage with more than two facilities. With the exception of fitness-only and YMCA/YWCA/JCC facilities, it appears that at least 37% or more of a typical facility’s members will have two or more facilities they engage with.

Going forward, club operators will need to ascertain how multiple-facility usage by their members will affect tenure, usage, and internal service monetization, as each of these may be influenced by this trend of using multiple facilities. They are also wise to be open to opportunities for collaboration and cross-marketing with other businesses whose offerings complement their own.

2019 Fitness Industry Trend: Global Market Growth

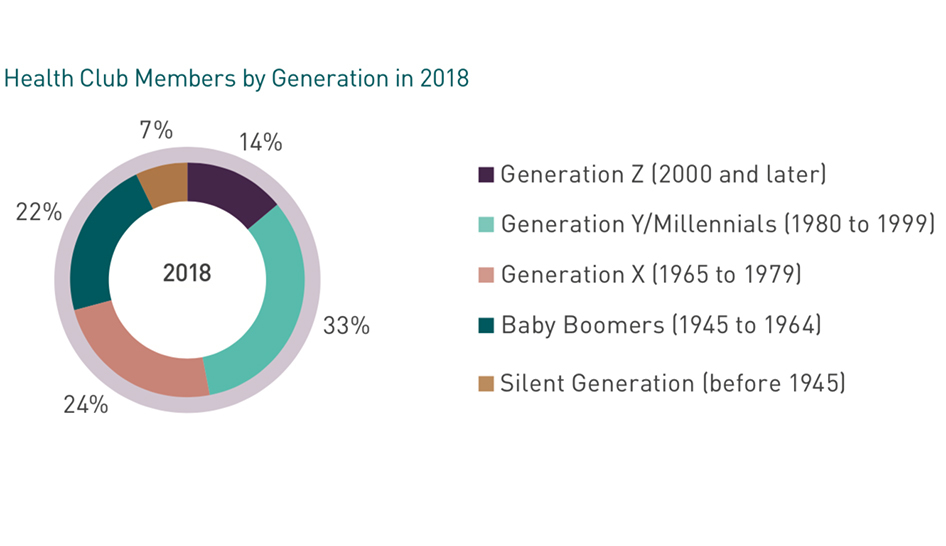

Global markets continue on an upward trend, from club revenue to number of facilities, according to the 2019 IHRSA Global Report. Worldwide, the industry saw membership grow to a “record-high” 183 million users, revenue totaling an estimated $94 billion, and club count exceeding 210,000 facilities in 2018.

Last year, many clubs and suppliers expanded their global reach and began to claim stake in promising markets. The Timonium, MD-based company PF Growth Partners, LLC, a franchise division of Planet Fitness, signed a deal to help bring a minimum of 35 Planet Fitness clubs to Australia. Management software company TSG, based in New Zealand, appointed a new position of CEO, Asia, to lead growth in the Japanese health and fitness market. Anytime Fitness opened a facility on all seven continents (yes, even Antarctica). Freemotion Fitness, a U.S.-based equipment manufacturer, has been tapping new directors and managers to lead growth in Canada, the U.K., and Latin America.

If 2019 is any indication, the industry is set to continue to grow in 2020, putting our goal of 230 million members by 2030 on track.

As the year goes forward, be sure to stay in the know with us as we continue to watch for new trends in an ever-changing landscape. And be sure to join us and your trendsetting peers at IHRSA 2020, March 18-21 in San Diego, CA.