North America

In the U.S. and Canada, closures lasted through the first quarter of 2021 in many states, provinces, and other jurisdictions. Last year, mandated restrictions allowed open clubs to operate outdoor-only and at 50% max indoor capacity in most parts of the region.

By year-end, 17% of gyms and fitness studios closed as the industry collectively lost 58% of revenue relative to 2019. According to the Fitness Industry Council of Canada, once fitness facilities opened in the Great North, they operated at approximately 50% of revenues. Much like the U.S., many clubs in Canada filed for bankruptcy.

The vast majority of fitness clubs in North America were allowed to open with fewer restrictions by mid-year 2021. However, industry damage continued as the number of closed facilities ballooned to 22% of all pre-COVID U.S. health clubs by the end of June. In the same month, Canada’s national health and fitness day was restricted to outdoor and home exercise only.

Clearly, the impact of the pandemic on the North American fitness industry will be reflected in 2021 performance, which may not be quantified until early 2022.

Latin America

The top Latin American markets encountered prolonged shutdowns, some continuing into 2021. Clubs in Mexico, Argentina, Colombia, and Chile were closed for several months. Brazil had regional closures in many parts of the country. In Peru, where closures dragged on into 2021, experts estimate that 30% of brick-and-mortar fitness businesses have closed permanently.

At the mid-year mark, the fitness industry in South America continued to struggle with new gym closings and delayed reopenings. At press time, clubs in Chile, Argentina, and parts of Brazil are contenders with another series of shutdowns as clubs in Peru continue to be closed.

“The short-term prospects are not good, since the region is entering the cold months and the pandemic is expected to hit even harder,” said Guillermo Velez, editor and director of Mercado Fitness. “Undoubtedly, Europe and the United States show us the light at the end of the tunnel, although we know that, unfortunately, many gyms [in South America] will not be able to survive the winter.”

Europe, Middle East, & Africa (EMEA)

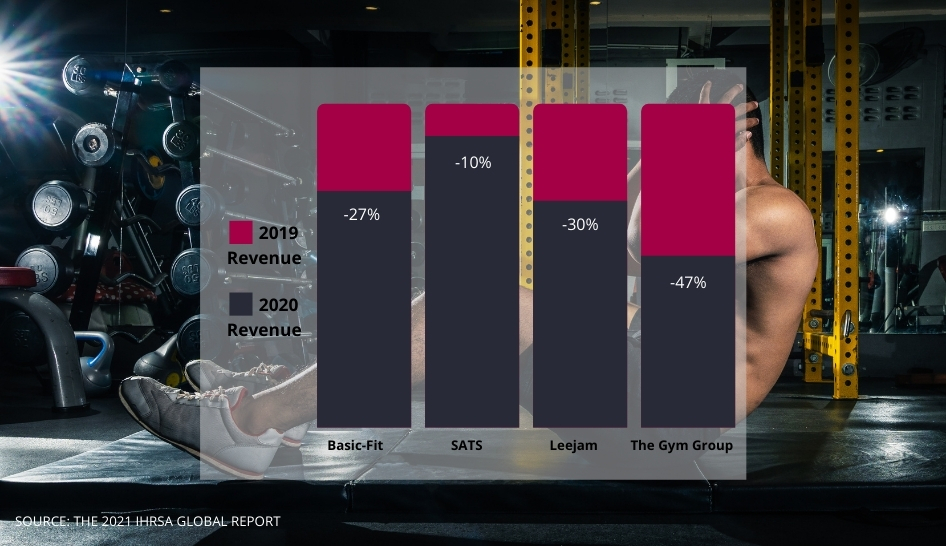

With the exception of Sweden, multiple waves of shutdowns across the EMEA region afflicted leading markets in 2020. Publicly listed companies felt the impact of the pandemic:

Basic Fit’s clubs in Benelux, Spain, and France encountered a decline in membership of 5% in 2020 as revenue dropped by 27%,

Nordic-based SATS saw membership fall by 9% while revenue decreased by 10%,

Saudi operator Leejam lost 6% of members and 30% of revenue, and

The UK’s Gym Group saw membership and revenue drop by 27% and 47%, respectively.