In the early days of the crisis, Congress passed three major pieces of COVID legislation and planned on releasing at least one more major COVID relief package. Instead, Congress passed piecemeal adjustments to the existing programs.

- March 6, 2020: the Coronavirus Preparedness and Response Supplemental Appropriations Act (Phase 1). The first bill Congress passed relating to the COVID-19 pandemic mainly focused on funding the research of a vaccine, public health infrastructure, and medical supplies.

- March 18, 2020: the Families First Coronavirus Response Act (Phase 2). The second bill provided funding for free coronavirus testing, 14-day paid leave for American workers affected by the pandemic and increased funding for food stamps.

- March 27, 2020: The Coronavirus Aid, Relief, and Economic Security (CARES) Act (Phase 3). Congress passes the first true economic relief package, providing $2 trillion in funding reserving $377 billion for assisting small businesses concentrated in the Paycheck Protection Program (PPP). The PPP provided small businesses with funds to pay up to 8 weeks of payroll costs, including benefits. Businesses could also use funds to pay interest on mortgages, rent, and utilities. Unlike restaurants and hotels, the health and fitness industry was not given special exemptions from the eligibility requirements leaving many in the industry without relief.

- April 24, 2020: Congress passes the Paycheck Protection Program and Health Care Enhancement Act (Phase 3.5). The $349 billion initially allocated to the PPP ran out in just 13 days. So Congress allocated an additional $320 billion to fund the PPP. However, the eligibility rules still blocked many businesses in the health and fitness industry from receiving funds.

- May 12, 2020: The House of Representatives passed the Health and Economic Recovery Omnibus Emergency Solutions or HEROES Act (Phase 4). This bill would have provided another $3 trillion in relief, including $290 billion to support small businesses and employee retention, with modifications to the PPP. However, the bill was seen as too expensive by the Senate and was considered “dead on arrival.”

- June 5, 2020: Congress passes The Paycheck Protection Program Flexibility Act amending the PPP’s initial provisions to allow more small businesses to take advantage of it.

- July 4, 2020: Congress passes a Paycheck Protection Program deadline extension, extending the PPP application process through August 8, 2020.

- October 1, 2020: The House of Representatives passed a revamped $2.2 trillion stimulus package, which is effectively a slimmed down version of the HEROES Act. The bill includes relief for families, businesses and schools, with specific cutouts for the restaurant and airline industries. The Senate is unlikely to vote on the bill, unless a deal can be reached with House Democrats and the White House.

The June and July changes were great in that it allowed more health and fitness clubs to apply for a PPP loan, but unfortunately, they have not helped the health and fitness industry as much as other hard-hit industries or as much as is desperately needed.

When it started looking like the next relief package would once again leave out health clubs, IHRSA worked on a bill specifically designed to provide the industry the relief that it so desperately needs.

The Health and Fitness Recovery Act (H.R.8485)

To address the health and fitness industry’s unique and pressing needs, Reps. Michael Quigley (D-IL) and Brian Fitzpatrick (R-PA) have stepped forward and filed the Health & Fitness Recovery Act of 2020 on Thursday, October 1.

This package would create a $30 billion fund to provide grants to affected health and fitness businesses. These grants would cut off at actual business loss up to 10% of the previous year’s revenue or $10 million, whichever is less.

Eligible expenses include:

- Payroll costs;

- Payments of principal or interest on any mortgage obligation;

- Rent payments, including rent under a lease agreement;

- Utilities;

- Maintenance, including construction or reconfiguration to accommodate social distancing requirements;

- Supplies, including protective equipment and cleaning materials;

- Debt obligations to suppliers incurred before the covered period; and

- Any other expenses that the Secretary determines to be essential to maintaining the eligible entity.

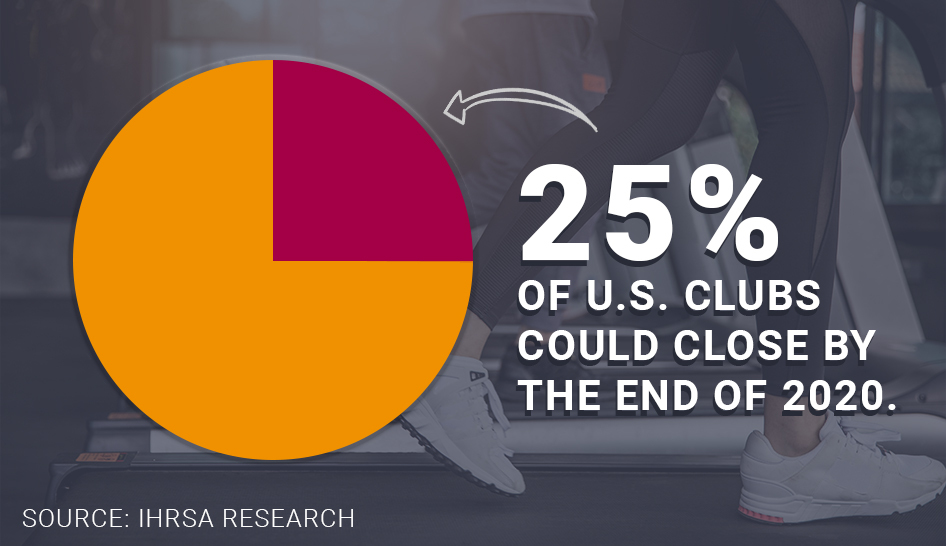

While the relief packages to date have helped many businesses around the country to survive the pandemic, for the health and fitness industry they are not enough. As long as congressional negotiations continue to stall on Phase 4, the health and fitness industry will not get the relief that it so desperately needs.

We need to come together as an industry to support the Health and Fitness Recovery Act to get the industry relief it needs to survive! Take action today and ask your member of Congress to support the Health and Fitness Recovery Act.