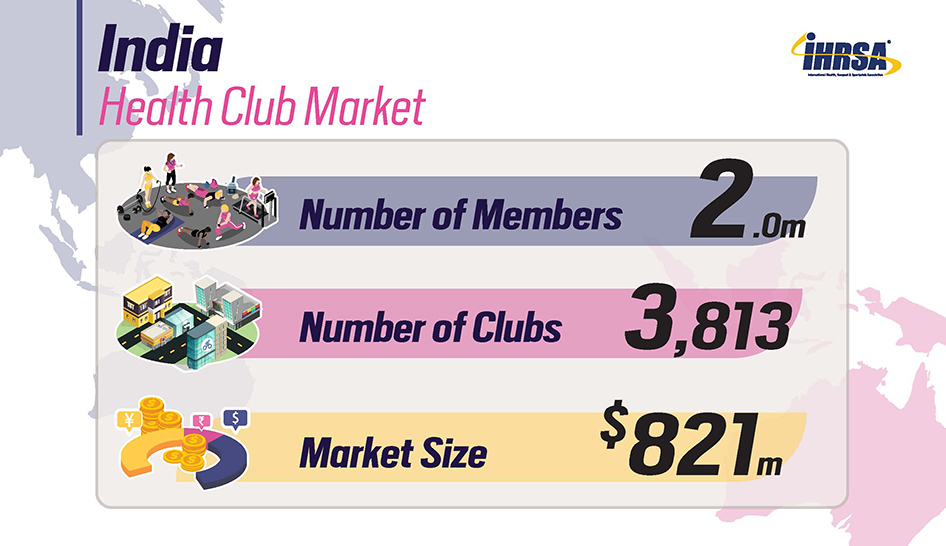

Home to one of the global economic powers, the health club market in India is among the largest in the Asia-Pacific region. India ranks fifth in market size among Asia-Pacific health club markets at $821 billion in annual revenue (USD). The number of health club locations ranks third in the region at 3,813 sites, while the country’s 2 million members ranks fifth among observed markets.

Although the health club market in India is robust compared to other Asia-Pacific markets, the club industry in India lags behind that of other developed economies. In terms of industry revenue, number of members, and number of clubs, India ranks outside of the top 10, according to the 2018 IHRSA Global Report. Considering this, India has at least three key areas to grow as a global health club market leader.