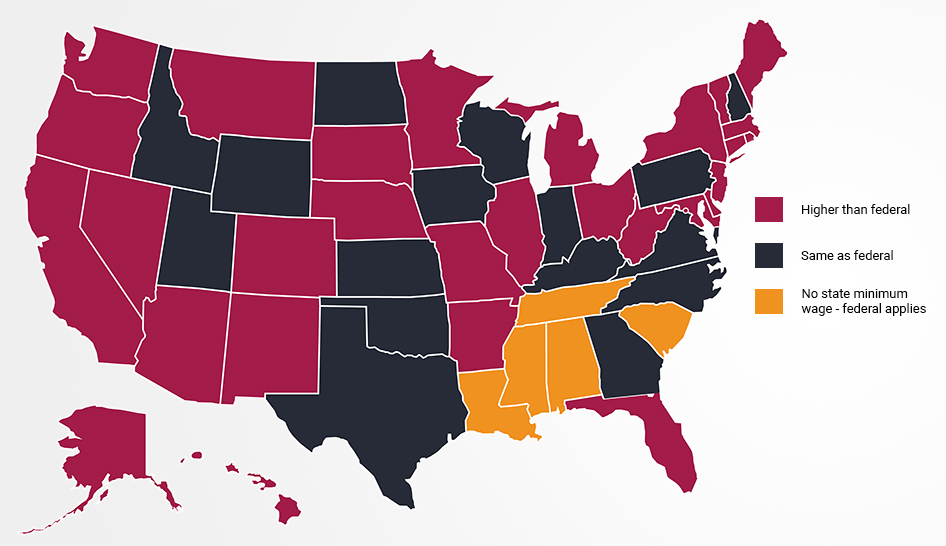

In addition to the 21 states where minimum wage increases took effect this year, 32 states considered some form of bill to increase the minimum wage in their state. Connecticut, New Jersey, Illinois, Maryland, New Mexico, and Nevada passed legislation to raise the minimum wage. These changes won't happen all at once. Most states chose to gradually roll out the increases over the next several years.

Paid Family and Medical Leave

Another example of the legislative tide turning toward the expansion of employee rights and benefits is the rise of paid family and medical leave legislation.

The federal Family and Medical Leave Act (FMLA) of 1993 allows eligible employees to take up to 12 weeks of unpaid leave—during any 12-month period. The FMLA covers:

- caring for a new child,

- caring for a severely ill family member, or

- recovering from a serious illness.

However, several states are considering expanding on the federal guaranteed unpaid leave through the requirement of paid family leave.

Currently, nine states and Washington, D.C., have paid family and medical leave (PFML) laws on the books. These states include:

- California,

- Connecticut,

- Massachusetts,

- New Jersey,

- New York,

- Rhode Island,

- Oregon, and

- Washington state.

States structure the PFML benefit differently, but typically an employee is entitled to a certain number of weeks for family leave, ranging from four weeks in Rhode Island and up to 12 weeks in Massachusetts.

Employees are also entitled to a certain number of weeks for a personal disability or medical leave, ranging from two weeks in Washington, D.C., to 52 weeks in California. A few states—like Massachusetts—cap the total number of weeks of PFML an employee can take in a year.

The Impact for Health Clubs

Calculating the impact of a minimum wage increase on your club can be easy, but is dependent on how you pay your employees. So, any increase may require a club owner to re-examine their salary structure. Some new laws, such as the rise of PFML may require more consideration in assessing its potential impact on your operations.