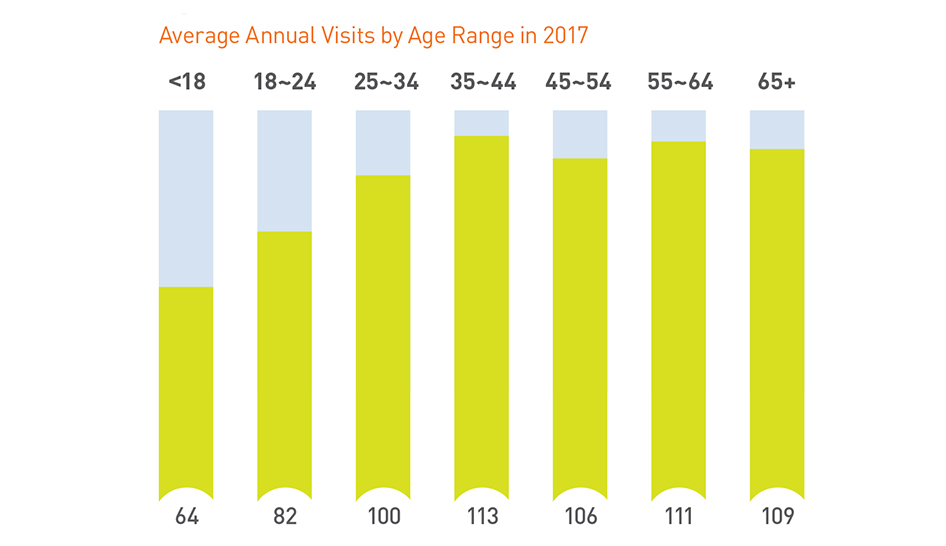

In the United States, health clubs serve more than 60 million members and another 9 million non-members. Although there are fitness and health outlets for just about any niche, health clubs, gyms, and studios tend to be the playground for the young as more than 75% of health club members are under the age of 55. Less than one out of four health club members come from the Baby Boomer and Silent generations.

According to the U.S. Census, Baby Boomers and Silents make up 28% of the population. While this percentage will decrease over the next two decades, they will remain a large segment of the population over the next several years. Along with their unique fitness needs and active aging goals, older generational groups are fertile ground for the industry.

The IHRSA Health Club Consumer Report shows the opportunities to attract and engage Boomers and Silents have significant profit and growth implications for club owners and managers. Delving into the report, we can examine three key characteristics of Boomers and Silents that can help drive club member growth and, ultimately, profits.